By: Gwen Moran

Published: October 22, 2010

How you manage your home ownership finances affects your credit score—and your ability to refinance later...

Your credit score affects how much you’ll pay for a mortgage or refinance—or even if you can get one at all. Master the six ways to manage home-related spending to keep your credit score braggingly high.

1. Postpone that refinance until your credit is squeaky clean

Even a small blemish on a credit report can cost you at closing. Money expert Denise Winston found that out firsthand: Her husband hadn’t paid a $40 pager charge. The unpaid bill was turned over to a collection agency and ended up damaging his credit score.

Because of that one small unpaid bill, the interest rate on the couple’s mortgage was 0.25% higher than if he’d had a clean score. Put another way, that’s $13,000 over the life of the loan.

The lesson? Even small items can damage your financial position. Get your credit report beforehand to see if there’s anything damaging. If so, consider postponing a refinance or HELOC (home equity line of credit) until small but potentially costly dings fade over time.

2. Pay your mortgage—now

Not all late payments are created equal: Almost nothing hits your credit score harder than a late mortgage payment. Payment history generally accounts for 35% of your credit score, which is bad enough, but credit score agencies consider late home payments graver than late credit card or car loan payments.

In fact, credit score agency VantageScore will knock off more than 100 points beyond what it would do for delinquent auto loans or credit cards.

But if you think you can improve your credit score with early payments, think again. Geoff Williams, co-author of Living Well with Bad Credit, says it may make a slightly positive impression on today’s risk-averse lender, but it won’t make a big difference in getting future credit.

3. Cool it on second mortgages and HELOCs

Drawing down a second mortgage or HELOC can have a negative impact on your credit score because 30% of your credit score is based on how much you owe to creditors. However, if you pay the loan on time, it will have less of an impact, says Winston.

Also, you can mitigate the credit score damage of a HELOC by staying within 30% of the limit.

4. Protect your mortgage to protect your insurance rates

Late payments on your mortgage may also affect your home owners and automobile insurance rates, potentially costing you hundreds of dollars a year, says Williams. Insurers may assume that if you’re strapped for cash and pay your bills late, you’re more likely to file a claim because you need the money.

5. Pay your utility bills and property taxes on time

If you’re late on your utility bills and your account is assigned to a collection agency, that agency may report it, causing a drop in your credit score, says Winston. The good news is that utility companies often don’t bother to report late bills to credit bureaus until your delinquency becomes serious.

Interestingly, late payment of property taxes won’t affect your credit score unless you find yourself with a lien on your property. Since liens are public records, they may appear on your credit report and might cause a drop in your credit score.

6. Refinancing? Beware of taking out equity, too

Refinancing your home generally won’t have an impact on your credit score as long as you continue to pay your loan on time, says Williams. However, if you extract equity in the deal, you could marginally affect your credit score because the amount you owe will increase.

Gwen Moran is a freelance business and finance writer from the Jersey shore. She’s the co-author of The Complete Idiot’s Guide to Business Plans and writes frequently about real estate.

Where you can learn all about the latest Nashville real estate, hot spots and new developments!

Monday, December 20, 2010

Thursday, December 16, 2010

Foreclosures Fall to Lowest Level in 18 Months!

LOS ANGELES — The number of U.S. homes taken back by lenders dropped to the lowest level in 18 months in November, the result of foreclosure freezes enacted by several banks following allegations that evictions were handled improperly.

Home repossessions dropped 28 percent from October and 12 percent from November last year, foreclosure listing firm RealtyTrac Inc. said Thursday.

The 67,428 homes lenders took back last month were the fewest since May 2009.

But even with the decline, it was enough to push the total number of repossessions so far this year to more than 980,000 — the highest annual tally of properties lost to foreclosure on RealtyTrac's records dating back to 2005.

"It's almost impossible to imagine that we won't break a million" for the year, said Rick Sharga, a senior vice president at RealtyTrac. "Unfortunately, it's a record that we'll probably break again next year."

'Rapid acceleration'

Several lenders responded to heightened scrutiny over the foreclosure process by temporarily ceasing taking action against borrowers severely behind in payments while they checked to see if their employees made errors in loan documents needed to complete foreclosures.

But activity will likely pick up with in the new year.

"In the first quarter, we really anticipate seeing a pretty rapid acceleration of foreclosure proceedings as everybody catches up," Sharga said.

Banks' foreclosure document problems aside, many of the factors that have contributed to the foreclosure crisis are likely to be present next year and should continue to drive foreclosures.

Among them: high unemployment, a weak housing market, flat-to-falling home values and tighter lending standards making it tougher for buyers to qualify for financing.

..In addition, there are some 5 million mortgages that are at least two months past due, and many of them have yet to even enter the foreclosure process.

Meanwhile, millions of homeowners owe more on their mortgage than their home is worth, which makes it more likely they will default on their loan.

10.8 million homes under water

About 10.8 million households, or 22.5 percent of all homes with a mortgage, were under water in the July-September quarter, according to housing data firm CoreLogic.

The figure is down from 23 percent in the second quarter, mainly because more homes fell into foreclosure and not because home prices increased.

In all, 262,339 U.S. homes received at least one foreclosure-related notice in November, or one in every 492 households.

The notices were down 21 percent from October and down 14 percent from November last year, RealtyTrac said.

The firm tracks notices for defaults, scheduled home auctions and home repossessions — warnings that can lead up to a home eventually being lost to foreclosure.

The decline in foreclosure activity was most pronounced in the more than 20 states that require foreclosures to be approved by judges and where many of the documentation errors came to light.

Initial notices sent to homeowners in those states who fell behind on their mortgage were off 43 percent from last year, while foreclosure auctions were down 38 percent, RealtyTrac said.

Some 37 states recorded a drop in home repossessions from October to November.

Nevada No. 1

The number of foreclosure-related notices sent to homes in Nevada fell 20 percent from October, but the state still registered the highest foreclosure rate in the U.S. last month, with one in every 99 households receiving a foreclosure notice. That's nearly 5 times the national average.

Utah leapfrogged several states to the No. 2 spot, mostly because of sharp monthly drops in foreclosure activity in California, Florida, Arizona and Michigan.

One in every 221 households in Utah received a foreclosure-related notice in November, more than twice the national average.

California posted the third-highest foreclosure rate despite a nearly 14 percent drop in foreclosure activity.

Rounding out the top 10 states with the highest foreclosure rate in November were: Arizona, Florida, Georgia, Michigan, Idaho, Illinois and Colorado.

Information gathered from www.msnbc.com

Home repossessions dropped 28 percent from October and 12 percent from November last year, foreclosure listing firm RealtyTrac Inc. said Thursday.

The 67,428 homes lenders took back last month were the fewest since May 2009.

But even with the decline, it was enough to push the total number of repossessions so far this year to more than 980,000 — the highest annual tally of properties lost to foreclosure on RealtyTrac's records dating back to 2005.

"It's almost impossible to imagine that we won't break a million" for the year, said Rick Sharga, a senior vice president at RealtyTrac. "Unfortunately, it's a record that we'll probably break again next year."

'Rapid acceleration'

Several lenders responded to heightened scrutiny over the foreclosure process by temporarily ceasing taking action against borrowers severely behind in payments while they checked to see if their employees made errors in loan documents needed to complete foreclosures.

But activity will likely pick up with in the new year.

"In the first quarter, we really anticipate seeing a pretty rapid acceleration of foreclosure proceedings as everybody catches up," Sharga said.

Banks' foreclosure document problems aside, many of the factors that have contributed to the foreclosure crisis are likely to be present next year and should continue to drive foreclosures.

Among them: high unemployment, a weak housing market, flat-to-falling home values and tighter lending standards making it tougher for buyers to qualify for financing.

..In addition, there are some 5 million mortgages that are at least two months past due, and many of them have yet to even enter the foreclosure process.

Meanwhile, millions of homeowners owe more on their mortgage than their home is worth, which makes it more likely they will default on their loan.

10.8 million homes under water

About 10.8 million households, or 22.5 percent of all homes with a mortgage, were under water in the July-September quarter, according to housing data firm CoreLogic.

The figure is down from 23 percent in the second quarter, mainly because more homes fell into foreclosure and not because home prices increased.

In all, 262,339 U.S. homes received at least one foreclosure-related notice in November, or one in every 492 households.

The notices were down 21 percent from October and down 14 percent from November last year, RealtyTrac said.

The firm tracks notices for defaults, scheduled home auctions and home repossessions — warnings that can lead up to a home eventually being lost to foreclosure.

The decline in foreclosure activity was most pronounced in the more than 20 states that require foreclosures to be approved by judges and where many of the documentation errors came to light.

Initial notices sent to homeowners in those states who fell behind on their mortgage were off 43 percent from last year, while foreclosure auctions were down 38 percent, RealtyTrac said.

Some 37 states recorded a drop in home repossessions from October to November.

Nevada No. 1

The number of foreclosure-related notices sent to homes in Nevada fell 20 percent from October, but the state still registered the highest foreclosure rate in the U.S. last month, with one in every 99 households receiving a foreclosure notice. That's nearly 5 times the national average.

Utah leapfrogged several states to the No. 2 spot, mostly because of sharp monthly drops in foreclosure activity in California, Florida, Arizona and Michigan.

One in every 221 households in Utah received a foreclosure-related notice in November, more than twice the national average.

California posted the third-highest foreclosure rate despite a nearly 14 percent drop in foreclosure activity.

Rounding out the top 10 states with the highest foreclosure rate in November were: Arizona, Florida, Georgia, Michigan, Idaho, Illinois and Colorado.

Information gathered from www.msnbc.com

Wednesday, December 15, 2010

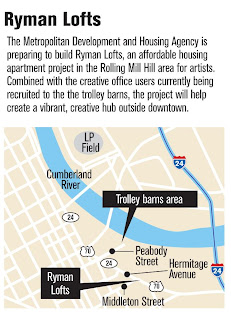

New Artist Lofts Coming Soon!

Nashville Business Journal - by Eric Snyder

A new apartment development is aiming directly at the economic strength of a surprising bunch: artists.

The Metropolitan Development and Housing Agency is set to begin construction next summer on the $5 million Ryman Lofts, a 60-unit affordable apartment development for artists in Rolling Mill Hill along Hermitage Avenue.

Starving may be the most-used adjective to describe artists, but arts districts in cities like Portland, Ore., Asheville, N.C., and Paducah, Ky., show they can also nurture thriving neighborhoods. In addition to bringing businesses in the vicinity, such districts can also help attract new residents across the city.

“It first starts with making housing affordable for artists,” said Jennifer Cole, executive director of the Metro Arts Commission.

Artists beget galleries and boutique store-studio combinations. More foot traffic leads to more opportunities for street-level retail like cafes, galleries and other craft-based businesses. Other creative businesses, like design firms, also are attracted to these areas.

“Anything that’s sort of interesting and is not ... a national brand but is kind of more local in its character,” said T.K. Davis, a professor at the University of Tennessee-Knoxville’s College of Architecture and Design and a board member of the Nashville Civic Design Center.

On this front, the area should see a boost from the efforts of The Mathews Co., which is handling leasing for the trolley barns, another MDHA project along Hermitage. Groups like the Nashville Entrepreneur Center and Emma have already announced plans to move to the redevelopment project, while others, like The Center for Nonprofit Management and Hands On Nashville, have signed letters of intent.

“The goal of any art district is to make it a destination — to make people want to come,” Cole said. Without affordable housing options, areas that gentrify around an artistic hub can price the actual artists out of the neighborhood, she said.

Phil Ryan, executive director of MDHA, said the lofts will primarily consist of one-bedroom units, with a few three-bedroom units for families. Although Ryan said he was unsure what rents may look like when residents begin to move in during the summer of 2012, he said prices for the one-bedroom units would be near $650 and three-bedroom units would run $750 to $900 if they were renting today.

Ryan said the concept stemmed from conversations between MDHA, the mayor’s office and the Nashville Music Council. The Ryman Lofts are being created with musicians in mind, but other artists would not be precluded, Ryan said.

Nashville-based architectural firm Smith Gee Studio is designing the lofts.

The lofts will “provide affordable housing for artists and include unconventional floor plans, large windows, hard surfaces and significant meeting spaces that are conducive to artistic endeavors,” according to MDHA’s website.

Having districts designed around artists can help reinforce a city’s brand of being a creative city. The Metro Arts Commission sought to expand awareness of its creative opportunities last month, when it released the results of a study evaluating the city’s Creative Vitality Index.

Nashville’s creative index — as judged by things like the number of jobs in creative industries, participation in local artistic activities and revenue of nonprofits — ranked fourth in the country, behind Washington, D.C., Los Angeles and New York.

Ryan said construction bids on the project should go out in the spring. Work is to begin this summer

A new apartment development is aiming directly at the economic strength of a surprising bunch: artists.

The Metropolitan Development and Housing Agency is set to begin construction next summer on the $5 million Ryman Lofts, a 60-unit affordable apartment development for artists in Rolling Mill Hill along Hermitage Avenue.

Starving may be the most-used adjective to describe artists, but arts districts in cities like Portland, Ore., Asheville, N.C., and Paducah, Ky., show they can also nurture thriving neighborhoods. In addition to bringing businesses in the vicinity, such districts can also help attract new residents across the city.

“It first starts with making housing affordable for artists,” said Jennifer Cole, executive director of the Metro Arts Commission.

Artists beget galleries and boutique store-studio combinations. More foot traffic leads to more opportunities for street-level retail like cafes, galleries and other craft-based businesses. Other creative businesses, like design firms, also are attracted to these areas.

“Anything that’s sort of interesting and is not ... a national brand but is kind of more local in its character,” said T.K. Davis, a professor at the University of Tennessee-Knoxville’s College of Architecture and Design and a board member of the Nashville Civic Design Center.

On this front, the area should see a boost from the efforts of The Mathews Co., which is handling leasing for the trolley barns, another MDHA project along Hermitage. Groups like the Nashville Entrepreneur Center and Emma have already announced plans to move to the redevelopment project, while others, like The Center for Nonprofit Management and Hands On Nashville, have signed letters of intent.

“The goal of any art district is to make it a destination — to make people want to come,” Cole said. Without affordable housing options, areas that gentrify around an artistic hub can price the actual artists out of the neighborhood, she said.

Phil Ryan, executive director of MDHA, said the lofts will primarily consist of one-bedroom units, with a few three-bedroom units for families. Although Ryan said he was unsure what rents may look like when residents begin to move in during the summer of 2012, he said prices for the one-bedroom units would be near $650 and three-bedroom units would run $750 to $900 if they were renting today.

Ryan said the concept stemmed from conversations between MDHA, the mayor’s office and the Nashville Music Council. The Ryman Lofts are being created with musicians in mind, but other artists would not be precluded, Ryan said.

Nashville-based architectural firm Smith Gee Studio is designing the lofts.

The lofts will “provide affordable housing for artists and include unconventional floor plans, large windows, hard surfaces and significant meeting spaces that are conducive to artistic endeavors,” according to MDHA’s website.

Having districts designed around artists can help reinforce a city’s brand of being a creative city. The Metro Arts Commission sought to expand awareness of its creative opportunities last month, when it released the results of a study evaluating the city’s Creative Vitality Index.

Nashville’s creative index — as judged by things like the number of jobs in creative industries, participation in local artistic activities and revenue of nonprofits — ranked fourth in the country, behind Washington, D.C., Los Angeles and New York.

Ryan said construction bids on the project should go out in the spring. Work is to begin this summer

Tuesday, December 14, 2010

Should a Parent Give Their Child Money for a Down Payment??

Should a Parent Give Their Child Money for a Down Payment?

According to the National Association of Realtors, 36% of first time home buyers got help with their down payment from family, up from 28% the previous year.

When talking to first time home buyers about getting help with the down payment, be aware of a few things.

• Gifts are allowed on conventional mortgages but at least 20% must be put down on the house in order to use the gifts.

• Each parent can give up to $13,000 tax-free per year to their child and $13,000 tax-free to their child’s spouse.

• If a parent co-signs with their child but will not occupy the property, the buyer will only qualify for rates as a primary residence if the loan is done through FHA with 3.5% down or Freddie Mac with 20% down. Otherwise, the rate will be for an investment property at around 1% higher.

• The gift must come from a family member with confirmation coming from a gift letter and cancelled check.

• Gift funds are most common on FHA loans where only 3.5% is needed as a down payment.

Mortgage Rates Rising Rapidly

Highest Since Early Summer

From what I can grasp, there are 2 main reasons why the rates have increased more than half a percent in less than a month.

First, investors are becoming increasingly wary of the United State’s ability to pay back its debt. With the proposed 2 year extension of the Bush tax cuts seemingly approved, the U.S. is projected to lose up to 900 billion by some estimates over the next few years in tax revenue. With the federal deficit already enormous, many investors and even some rating agencies are starting to worry that the U.S. will not be able to pay back all its debt.

Secondly, the expectations for growth in the U.S. economy have increased dramatically over the last few weeks. With consumer confidence rising, retail spending up, and manufacturing orders beating projections, economists are predicting larger growth in the U.S. economy over the next few years.

These two occurrences have driven investors out of safe haven assets like treasury bonds and mortgage backed securities and into higher risk, higher yield investments. When this happens, bond rates must increase to attract investors who can get higher returns elsewhere. Hence, higher mortgage rates.

My Two Cents:

The U.S. unemployment rate still stands at 9.8%, and with consumer spending making up almost 70% of all GDP, I think investors are being a little too optimistic on economic growth.

Let’s at least hope the optimistic economic forecast translates into a higher number of sales in the purchase market, because higher interest rates and declining homes sales and prices could be disastrous for the housing market and the overall economy.

Info gathered by: Michael Ribas

@ SunTrust Mortgage

Rates Hit 6-Month High!

Mortgage rates rose for a fourth straight week to reach a six-month high, as yields on government bonds continue to rise. The average interest on a 30-year fixed loan hit 4.61 percent this past week, up from 4.46 percent a week earlier, Freddie Mac reported. Also, 15-year fixed loans averaged 3.96 percent, up from 3.81 percent the previous week; and rates for variable adjustable-rate mortgages floated higher as well.

[SOURCE: Freddie Mac]

[SOURCE: Freddie Mac]

Monday, December 13, 2010

"Where Do We Go From Here??"

Where do we go from here?

That question from Alicia Keys? song is on the minds of many Americans, as they wonder where home loan rates are headed after the recent negative news for Bonds.

Last week, Congress was busy at work on negotiations to extend the Bush-era tax cuts. That news kept a lid on any improvement for Bonds and home loan rates, due to the prospect of an ever-increasing deficit.

And adding to the troubles for Bonds and home loan rates last week was news that inflation is growing in China... and growing fast. How does that impact us? Remember, it's a global economy, so Bond prices all over the world worsen on news of inflation, which is bad for home loan rates.

So the big question is: Will home loan rates go back down? Although rates are still near historic lows, they have been headed up... and indications are that those unbelievably low home loan rates may be behind us. In fact, there are only a few things that would bring back the lows that we saw in early November:

• If the tax cut package doesn't get passed, it would be very bad news for the economy and Stock market - but it would help interest rates.

• If the Fed's recent round of Quantitative Easing falls on its face and doesn't meet its mission of creating inflation, boosting Stock prices, lowering unemployment and creating consumer demand - Bond prices could make some gains as the threat of deflation reemerges. But this is a long shot.

• If the financial problems in Europe worsen significantly - which would drive investors into the safe haven of the US Bond market - it could help Bond prices, but probably only modestly.

Realistically, the chances of these events happening are unlikely - and in the end, rates may see some brief and fleeting improvements, but many experts believe they will likely continue to creep up over time. And when you include the stimulative action of extending the present tax rates and adding further cuts, it's tough to see Bonds or home loan rates improving much.

The good news is that home loan rates are still extremely attractive and are still near historic lows for now. If you or someone you know has been thinking about purchasing or refinancing a home, NOW is the time to call or email to get started.

Info from: Shane Atwell from Primary Residential Mortgage

That question from Alicia Keys? song is on the minds of many Americans, as they wonder where home loan rates are headed after the recent negative news for Bonds.

Last week, Congress was busy at work on negotiations to extend the Bush-era tax cuts. That news kept a lid on any improvement for Bonds and home loan rates, due to the prospect of an ever-increasing deficit.

And adding to the troubles for Bonds and home loan rates last week was news that inflation is growing in China... and growing fast. How does that impact us? Remember, it's a global economy, so Bond prices all over the world worsen on news of inflation, which is bad for home loan rates.

So the big question is: Will home loan rates go back down? Although rates are still near historic lows, they have been headed up... and indications are that those unbelievably low home loan rates may be behind us. In fact, there are only a few things that would bring back the lows that we saw in early November:

• If the tax cut package doesn't get passed, it would be very bad news for the economy and Stock market - but it would help interest rates.

• If the Fed's recent round of Quantitative Easing falls on its face and doesn't meet its mission of creating inflation, boosting Stock prices, lowering unemployment and creating consumer demand - Bond prices could make some gains as the threat of deflation reemerges. But this is a long shot.

• If the financial problems in Europe worsen significantly - which would drive investors into the safe haven of the US Bond market - it could help Bond prices, but probably only modestly.

Realistically, the chances of these events happening are unlikely - and in the end, rates may see some brief and fleeting improvements, but many experts believe they will likely continue to creep up over time. And when you include the stimulative action of extending the present tax rates and adding further cuts, it's tough to see Bonds or home loan rates improving much.

The good news is that home loan rates are still extremely attractive and are still near historic lows for now. If you or someone you know has been thinking about purchasing or refinancing a home, NOW is the time to call or email to get started.

Info from: Shane Atwell from Primary Residential Mortgage

Friday, December 10, 2010

Mortgage Rates Hit Six Month High, Threatening Housing

Rates on fixed mortgages rose for the fourth straight week this week, hitting 4.61 percent. The surge could slow refinancings and further hamper the housing market.

Freddie Mac said Thursday that the average rate on a 30-year fixed loan increased sharply from last week's rate. And it is well above the 4.17 percent rate hit a month ago— the lowest level on records dating back to 1971.

The average rate on a 15-year fixed loan rose to 3.96 percent. Rates hit 3.57 percent last month—the lowest level since 1991.

Rates are rising after plummeting for seven months. Investors are selling Treasury bonds in anticipation of an extension of tax cuts and unemployment benefits that could boost the economy. That is raising the yield on Treasury bonds. Mortgage rates tend to track those yields.

The increase in rates already is discouraging homeowners interested in refinancing their homes. Refinance activity fell for the fourth straight week last week, according to the Mortgage Bankers Association.

However, the increase in rates may have convinced some homebuyers who were waffling to go ahead and make a move. Purchase application volume was up for the third consecutive week and is at its highest point since the beginning of May. Mortgage brokers and real estate agents agree that a sustained rise in mortgage rates eventually will sideline potential buyers.

To calculate average mortgage rates, Freddie Mac collects rates from lenders across the country on Monday through Wednesday of each week. Rates often fluctuate significantly, even within a single day.

Rates on five-year adjustable-rate mortgages averaged 3.60 percent, up from 3.49 percent. The five-year hit 3.25 percent last month, the lowest rate on records dating back to January 2005.

Rates on one-year adjustable-rate home loans slipped to 3.27 percent from 3.25 percent.

The rates do not include add-on fees, known as points. One point is equal to 1 percent of the total loan amount.

The average fee for 30-year and 15-year mortgages in Freddie Mac's survey was 0.7 point. It was 0.6 point for five-year and one-year mortgages.

Article from www.cnbc.com

Freddie Mac said Thursday that the average rate on a 30-year fixed loan increased sharply from last week's rate. And it is well above the 4.17 percent rate hit a month ago— the lowest level on records dating back to 1971.

The average rate on a 15-year fixed loan rose to 3.96 percent. Rates hit 3.57 percent last month—the lowest level since 1991.

Rates are rising after plummeting for seven months. Investors are selling Treasury bonds in anticipation of an extension of tax cuts and unemployment benefits that could boost the economy. That is raising the yield on Treasury bonds. Mortgage rates tend to track those yields.

The increase in rates already is discouraging homeowners interested in refinancing their homes. Refinance activity fell for the fourth straight week last week, according to the Mortgage Bankers Association.

However, the increase in rates may have convinced some homebuyers who were waffling to go ahead and make a move. Purchase application volume was up for the third consecutive week and is at its highest point since the beginning of May. Mortgage brokers and real estate agents agree that a sustained rise in mortgage rates eventually will sideline potential buyers.

To calculate average mortgage rates, Freddie Mac collects rates from lenders across the country on Monday through Wednesday of each week. Rates often fluctuate significantly, even within a single day.

Rates on five-year adjustable-rate mortgages averaged 3.60 percent, up from 3.49 percent. The five-year hit 3.25 percent last month, the lowest rate on records dating back to January 2005.

Rates on one-year adjustable-rate home loans slipped to 3.27 percent from 3.25 percent.

The rates do not include add-on fees, known as points. One point is equal to 1 percent of the total loan amount.

The average fee for 30-year and 15-year mortgages in Freddie Mac's survey was 0.7 point. It was 0.6 point for five-year and one-year mortgages.

Article from www.cnbc.com

Thursday, December 9, 2010

5 Things to Do Now in Order to Buy a Home in 2011

There are lots of purchases that are highly prone to impulse buying: shoes on sale, puppies at the pound, and carrot cupcakes with cream cheese buttercream frosting come instantly to mind. (But that's just me.)

But houses? Not so much. Savvy, regret-free homebuying can take weeks or months of financial and lifestyle research and planning. If you want 2011 to be the year you become a homeowner, here are 5 things you should be doing, as we speak.

1. Minimize your holiday spending and save your cash. Instead of using the holiday sales to acquire a new winter wardrobe of cashmere sweaters, hold the discretionary spending down so you can give yourself the gift of homeownership! If you are serious about buying a home next year, don't run up additional credit card debt on gifts this year. Instead, make homemade cards or write holiday letters this year for everyone except the kiddos. And even for the kids, consider scaling back on the stuff, spending more of your time with them than your money, and getting started now saving toward your home purchase. (I don't think too many folks would argue that a less materialistic holiday season would hurt anyone, at any age.)

Kickstart your 2011 homebuying resolution by starting a "Home" savings account at an high-interest, online bank (the discipline-boosting goal is a bank that isn't super easy to transfer funds out of when you run low on cash), and set up an automatic deposit into it every payday. To get specific about your savings goal, if you're cash-flush, obviously a 20% down payment will get you top notch interest rates and provide you with the maximum ability to manage your monthly payments. If you're going to be more of a bootstrapping buyer, an FHA loan might be right up your alley - they offer a down payment of 3.5% of the purchase price.

All buyers should plan to have at least 3 percent of the purchase price saved up for closing costs, even if you want the seller to chip in. The lower-priced the home you want to buy, the more percentage points you should be willing to chip in for closing costs. It's easy for closing costs on an $150,000 FHA loan to run as high as $4,000 or more, considering transfer taxes, inspections, appraisals and mortgage insurance fees. So, even the scrappiest buyer should have a savings target somewhere around 6.5% of their target home's price. To buy a $200,000 home, for example, that would mean a savings target of $13,000.

Local real estate and mortgage pros can help you clarify realistic "cash to close" expectations and savings targets for your area - ask them, on Trulia Voices.

2. Research financing, areas homes, prices, agents and online. Smart homebuying takes a lot of research and knowledge-gathering. Since most buyers find it much harder to qualify for a mortgage than it is to find a home you'd love to live in, start with studying up on home financing and what it will take for you to get a home loan (note: FHA loans are preferred by the average homebuyer on today's market who has less than a 10% down payment, so start your research there).

If you're considering relocating next year, now's the time to start narrowing down states, cities and even neighborhoods that may or may not work for you. Take into account the job market, housing and other costs of living, and income and property tax rates, as well as the critical lifestyle inputs that vary from state-to-state, like weather and whether the place is a personality fit for you and the life you want to live, be it urban sophisticate or outdoors adventurer.

Also, start to develop a feel for home prices in a what-you-get-for-your-money type way, and start narrowing down the home styles and even neighborhoods that might fit your aesthetic preferences and lifestyle. If you're one of those rare buyers-to-be who is not already obsessively house hunting, hop on Trulia and start regularly checking out homes and neighborhoods, making sure to take advantage of the neighborhood ratings and reviews feature, which empowers you to surface what other folks think and say about an area.

3. Rehab your credit, if you need to. Go to AnnualCreditReport.com and check out your credit reports - from all 3 bureaus - for free. (Note - these will not give you your credit score for free - that costs extra, but it will give you the actual detailed credit reports.) Audit them for errors and do the work of disputing inaccuracies to have them corrected. Pay particular attention to: accounts that are not yours/you never opened, derogatory information that should have "aged off" your report by now (i.e., 7 years for late payments, 10 for bankruptcies) and balances or credit limits that are inaccurate (i.e., your credit card balance is listed at $2500, but you actually only owe $250.) These are the errors most likely to foul up your financing, so follow the instructions each bureau provides to correct them, stat. While you're at it, don't close any accounts, even if you are able to pay some down or off - actually, check out these tips for getting the bank to give you the best possible home loan, without unintentionally making your score worse!

4. Run your numbers. In the past, some overextended homeowners complained that they felt pushed into a mortgage they couldn't afford. Pundits blamed that on the real estate and mortgage industry, but I have witnessed firsthand many a homebuyer push themselves or their spouses into buying too expensive of a home. Eliminate this issue entirely by doing this - run your own numbers, before you ever even talk to a salesperson or start looking at homes beyond your means. (I assure you, once you see the million dollar home you think you can afford, the $250,000 home you can actually afford will be underwhelming.)

Get your monthly finances in order, and get a clear read on how much your monthly bills are - outside of housing. Decide how much you can afford to spend every month for housing, when you buy your home. Get clear on exactly how much cash you plan to have at hand to put into your transaction up front. When, in the next step, you begin working with a mortgage broker, you'll want to share these numbers with them, early on in your conversation, to empower them to tell you what home price you can afford - not based on their rubrics, but based on what you say you want to spend every month and what you want to put down.

5. Talk to a real estate and mortgage broker (1 of each). Trulia is a great place to find an engaged, communicative, tech-savvy real estate broker or agent in your area. You can use our Find a Pro directory or simply start participating in the Trulia Voices Community, asking your questions and tagging them for the town where you plan to buy a home, and paying attention to the agents who give timely, thorough responses to your questions, and communicate in a language you understand.

Drop one (or a few) an email, letting them know you'd like to work on putting an action plan together for buying a home next year, and would like to talk with them about what action steps need to go on the list. Ask them to brief you on the timeline of a transaction in your local market, and to point out for you things like when along the process you'll need to bring money in, when you'll need to miss work and come into their office or the closing office, whether they offer conveniences like digital document signing, and generally the local standard practices about which buyers you'll need to know. Depending on your target home purchase timeline, they might even want you to take a spin with them and look at a few properties to reality-check your expectations or narrow down a broad wish list.

In addition to chatting with them about timing your purchase vis-à-vis your other life events and plans for the year, make sure to ask for referrals to a local, trustworthy mortgage broker or two - preferably one that has worked with them and closed a number of transactions with their clients. (In fact, many busy real estate pros will want you to talk with their trusty mortgage partner before they get too involved in your planning process. You may think you only need a month to get ready to buy, but once the mortgage folks weigh in, it might turn out that you actually need a few.) When you do get in touch with the mortgage maven, if you're serious about buying, you will want them to actually pull your credit report, check the actual FICO scores that come up on their system and give you their professional recommendations for what final tweaks you can do to your debts to get your credit score where it needs to be.

Article from Trulia by Tara@Trulia

But houses? Not so much. Savvy, regret-free homebuying can take weeks or months of financial and lifestyle research and planning. If you want 2011 to be the year you become a homeowner, here are 5 things you should be doing, as we speak.

1. Minimize your holiday spending and save your cash. Instead of using the holiday sales to acquire a new winter wardrobe of cashmere sweaters, hold the discretionary spending down so you can give yourself the gift of homeownership! If you are serious about buying a home next year, don't run up additional credit card debt on gifts this year. Instead, make homemade cards or write holiday letters this year for everyone except the kiddos. And even for the kids, consider scaling back on the stuff, spending more of your time with them than your money, and getting started now saving toward your home purchase. (I don't think too many folks would argue that a less materialistic holiday season would hurt anyone, at any age.)

Kickstart your 2011 homebuying resolution by starting a "Home" savings account at an high-interest, online bank (the discipline-boosting goal is a bank that isn't super easy to transfer funds out of when you run low on cash), and set up an automatic deposit into it every payday. To get specific about your savings goal, if you're cash-flush, obviously a 20% down payment will get you top notch interest rates and provide you with the maximum ability to manage your monthly payments. If you're going to be more of a bootstrapping buyer, an FHA loan might be right up your alley - they offer a down payment of 3.5% of the purchase price.

All buyers should plan to have at least 3 percent of the purchase price saved up for closing costs, even if you want the seller to chip in. The lower-priced the home you want to buy, the more percentage points you should be willing to chip in for closing costs. It's easy for closing costs on an $150,000 FHA loan to run as high as $4,000 or more, considering transfer taxes, inspections, appraisals and mortgage insurance fees. So, even the scrappiest buyer should have a savings target somewhere around 6.5% of their target home's price. To buy a $200,000 home, for example, that would mean a savings target of $13,000.

Local real estate and mortgage pros can help you clarify realistic "cash to close" expectations and savings targets for your area - ask them, on Trulia Voices.

2. Research financing, areas homes, prices, agents and online. Smart homebuying takes a lot of research and knowledge-gathering. Since most buyers find it much harder to qualify for a mortgage than it is to find a home you'd love to live in, start with studying up on home financing and what it will take for you to get a home loan (note: FHA loans are preferred by the average homebuyer on today's market who has less than a 10% down payment, so start your research there).

If you're considering relocating next year, now's the time to start narrowing down states, cities and even neighborhoods that may or may not work for you. Take into account the job market, housing and other costs of living, and income and property tax rates, as well as the critical lifestyle inputs that vary from state-to-state, like weather and whether the place is a personality fit for you and the life you want to live, be it urban sophisticate or outdoors adventurer.

Also, start to develop a feel for home prices in a what-you-get-for-your-money type way, and start narrowing down the home styles and even neighborhoods that might fit your aesthetic preferences and lifestyle. If you're one of those rare buyers-to-be who is not already obsessively house hunting, hop on Trulia and start regularly checking out homes and neighborhoods, making sure to take advantage of the neighborhood ratings and reviews feature, which empowers you to surface what other folks think and say about an area.

3. Rehab your credit, if you need to. Go to AnnualCreditReport.com and check out your credit reports - from all 3 bureaus - for free. (Note - these will not give you your credit score for free - that costs extra, but it will give you the actual detailed credit reports.) Audit them for errors and do the work of disputing inaccuracies to have them corrected. Pay particular attention to: accounts that are not yours/you never opened, derogatory information that should have "aged off" your report by now (i.e., 7 years for late payments, 10 for bankruptcies) and balances or credit limits that are inaccurate (i.e., your credit card balance is listed at $2500, but you actually only owe $250.) These are the errors most likely to foul up your financing, so follow the instructions each bureau provides to correct them, stat. While you're at it, don't close any accounts, even if you are able to pay some down or off - actually, check out these tips for getting the bank to give you the best possible home loan, without unintentionally making your score worse!

4. Run your numbers. In the past, some overextended homeowners complained that they felt pushed into a mortgage they couldn't afford. Pundits blamed that on the real estate and mortgage industry, but I have witnessed firsthand many a homebuyer push themselves or their spouses into buying too expensive of a home. Eliminate this issue entirely by doing this - run your own numbers, before you ever even talk to a salesperson or start looking at homes beyond your means. (I assure you, once you see the million dollar home you think you can afford, the $250,000 home you can actually afford will be underwhelming.)

Get your monthly finances in order, and get a clear read on how much your monthly bills are - outside of housing. Decide how much you can afford to spend every month for housing, when you buy your home. Get clear on exactly how much cash you plan to have at hand to put into your transaction up front. When, in the next step, you begin working with a mortgage broker, you'll want to share these numbers with them, early on in your conversation, to empower them to tell you what home price you can afford - not based on their rubrics, but based on what you say you want to spend every month and what you want to put down.

5. Talk to a real estate and mortgage broker (1 of each). Trulia is a great place to find an engaged, communicative, tech-savvy real estate broker or agent in your area. You can use our Find a Pro directory or simply start participating in the Trulia Voices Community, asking your questions and tagging them for the town where you plan to buy a home, and paying attention to the agents who give timely, thorough responses to your questions, and communicate in a language you understand.

Drop one (or a few) an email, letting them know you'd like to work on putting an action plan together for buying a home next year, and would like to talk with them about what action steps need to go on the list. Ask them to brief you on the timeline of a transaction in your local market, and to point out for you things like when along the process you'll need to bring money in, when you'll need to miss work and come into their office or the closing office, whether they offer conveniences like digital document signing, and generally the local standard practices about which buyers you'll need to know. Depending on your target home purchase timeline, they might even want you to take a spin with them and look at a few properties to reality-check your expectations or narrow down a broad wish list.

In addition to chatting with them about timing your purchase vis-à-vis your other life events and plans for the year, make sure to ask for referrals to a local, trustworthy mortgage broker or two - preferably one that has worked with them and closed a number of transactions with their clients. (In fact, many busy real estate pros will want you to talk with their trusty mortgage partner before they get too involved in your planning process. You may think you only need a month to get ready to buy, but once the mortgage folks weigh in, it might turn out that you actually need a few.) When you do get in touch with the mortgage maven, if you're serious about buying, you will want them to actually pull your credit report, check the actual FICO scores that come up on their system and give you their professional recommendations for what final tweaks you can do to your debts to get your credit score where it needs to be.

Article from Trulia by Tara@Trulia

Wednesday, December 8, 2010

Midtown Development Warming Up!

Nashville Business Journal - by Eric Snyder

Date: Tuesday, December 7, 2010

The buzz of new development in Nashville’s Midtown area is growing louder.

The Metro Planning Commission will consider an application this week to convert three parcels between Elliston Place and West End Avenue from commercial to mixed-use zoning to make way for a new hotel project.

The zone change request was submitted by Ragan-Smith Associates, Inc. on behalf of the property owner, RMRTN West END, LLC, a subsidiary of Memphis-based developer Robert M. Rogers Investments.

According to the application submitted to the planning commission, the 181,955-square-foot project would be built over two phases in two buildings. In addition to hotel space, the project calls for 3,168 square feet of retail space and 2,000 square feet of restaurant space. A 110,336-square-foot parking garage would be built below the facility.

The properties up for rezoning include 1.37 acres at 2400, 2402 and 2404 West End Avenue, currently home to an F.Y.E. music store and an adjacent two-story retail center.

Down the road on Elliston, Southern Land Co. is pursuing plans for 348,000-square-feet development at Elliston and 23rd Avenue, the former Father Ryan High School property.

The urban core bordered by Interstate 440 is currently getting a lot of attention from developers, especially for apartments. In addition to these projects, ground was recently broken for the Vista Germantown apartment community.

These deals show that the equity partners who make financing new projects possible are willing to get off the sideline and invest. They remain cautious in how they do so, however, hence the large number of investments in 'safer' projects like urban apartments.

Subscribe to:

Posts (Atom)